Travel insurance has become an essential consideration for anyone planning a trip, whether it’s a quick business trip across the country or an extended international vacation. While many travelers understand the importance of having coverage, the specifics of what travel insurance typically covers can sometimes be unclear. Knowing the scope and limitations of these policies not only helps travelers make informed decisions but also ensures they can navigate unexpected situations with greater confidence. The reality is that travel insurance is designed to address a range of potential challenges, helping mitigate financial risks and providing peace of mind during journeys that often involve considerable investment and uncertainty.

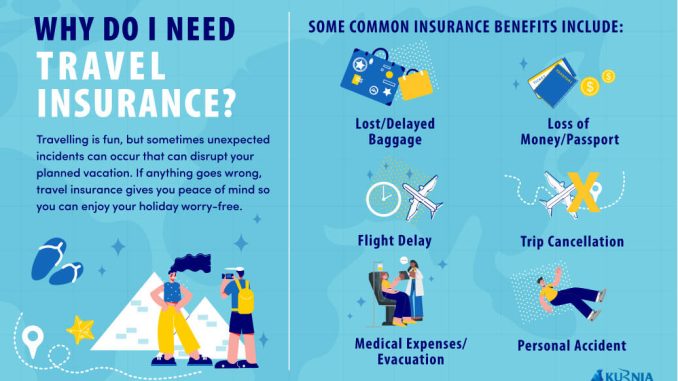

At its foundation, travel insurance often centers around protecting travelers from financial losses associated with unforeseen events that disrupt their plans. One of the most prominent areas of coverage is trip cancellation and interruption. This aspect of travel insurance safeguards the money already spent on non-refundable components of a trip—such as flights, hotels, and tours—if a traveler is forced to cancel or cut short their trip for valid reasons. For instance, if a traveler falls ill before departure or encounters a family emergency, trip cancellation coverage can reimburse them for costs that would otherwise be lost. Similarly, if unexpected circumstances like severe weather or political unrest interrupt a trip already underway, interruption coverage can help offset the additional expenses incurred when altering travel plans. This coverage provides a financial buffer that can be critical when dealing with the inherent unpredictability of travel.

Another crucial facet of travel insurance is medical coverage, which is often the most compelling reason many travelers opt for insurance. Unlike domestic health insurance policies, which frequently have limited or no coverage abroad, travel insurance typically offers emergency medical benefits specifically tailored to travelers. Medical emergencies can be both emotionally and financially overwhelming, especially when they occur far from home. Imagine a scenario where a business traveler suffers an accident while abroad. Without appropriate coverage, the cost of hospital care, medication, and even medical evacuation can be exorbitant. Travel insurance policies often include emergency medical evacuation, which ensures that the insured can be transported to the nearest facility capable of providing adequate care or even returned home if necessary. This feature alone can mean the difference between manageable expenses and financial disaster, particularly in countries where healthcare costs are high or facilities are limited.

In addition to cancellation and medical coverage, lost or delayed baggage is another common concern for travelers that travel insurance typically addresses. Losing luggage can cause considerable inconvenience, disrupting schedules and causing unexpected expenses for essentials like clothing and toiletries. While airlines may offer some reimbursement, their compensation often falls short of covering the full scope of losses or the inconvenience caused. Travel insurance steps in to fill this gap, offering compensation for lost belongings and helping cover costs when luggage is delayed. This kind of coverage can be especially important for travelers who rely on specific equipment or business materials that cannot easily be replaced.

Travel delays themselves can also be covered under many travel insurance policies. Delays caused by weather, mechanical failures, or other unexpected issues can result in additional costs such as meals, accommodations, or alternative transportation arrangements. While some airlines or travel providers offer limited assistance, travel insurance can provide reimbursement for these extra expenses, cushioning the financial blow and allowing travelers to better manage disruptions. For those traveling on tight schedules, this coverage ensures that delays don’t compound stress or result in out-of-pocket losses.

More specialized forms of travel insurance coverage have also become increasingly relevant in today’s travel environment. For example, many policies now include provisions related to COVID-19, such as coverage for trip cancellations due to illness or quarantine requirements. Similarly, some policies address risks associated with adventure sports or high-risk activities, providing medical coverage for injuries sustained during skiing, scuba diving, or hiking expeditions. These tailored options reflect the evolving needs of modern travelers and the growing complexity of travel risks.

It’s important to note that while travel insurance covers a broad range of potential mishaps, it doesn’t protect against everything. Most policies exclude coverage for pre-existing medical conditions unless they are declared and covered explicitly. Additionally, some exclusions may apply to losses resulting from risky behaviors, travel to high-risk destinations, or failure to comply with local laws. Understanding these limitations is critical when selecting a policy, as it ensures travelers are not caught off guard by unexpected gaps in their coverage.

For travelers considering purchasing insurance, the key to making the most of it lies in thoroughly reviewing policy details and matching coverage to individual needs. For example, a solo traveler heading to a developed country with comprehensive domestic health insurance might prioritize trip cancellation and baggage coverage. In contrast, someone planning an extended expedition in remote areas will likely need robust medical evacuation and emergency assistance benefits. Reviewing factors such as the length of the trip, destination risks, activities planned, and personal health conditions can guide travelers toward the most appropriate insurance package.

Ultimately, travel insurance is more than just a safety net—it’s a strategic tool that empowers travelers to manage risk effectively. By understanding what travel insurance typically covers, individuals and businesses can better prepare for the uncertainties that come with venturing away from home. Whether it’s a medical emergency in a foreign hospital, an unexpected flight cancellation, or a suitcase gone missing, travel insurance offers a layer of protection that allows travelers to focus on the experience rather than the potential pitfalls. In an era when travel is both more accessible and more complex, this clarity around insurance coverage is essential to ensuring that journeys remain rewarding and worry-free.